Annual Report 2024 - Challenges I Crushed (and Those That Crushed me)

"In Vietnam, every meal is an adventure, every ride a thrill, and every conversation a chance to learn how much you don’t know." - Me

Transitioning from a back office / middle office market facing role from Prime Brokerage to a client facing and engagement role is a great leap forward for my career path. The learning curve is steep and relationship management with closer friends VS more distant contacts is a whole different ball game. As my background was from an investment bank and most of my closer friends are highly sophisticated in terms of knowledge of financial products, investment strategies, and different types of financials services, I had to be very sharp in terms of what value I can bring to them and also deal with different variety of personalities and requests, as well as value added services. Also by talking to a broader set of audiences beyond my closest clique of friends, I better understand different motivations and interests as well as risk appetite on why people prefer a specific style of financial planning over the other.

As a self-employed personnel currently, I am in charge of my time and my deal flow and need to be vigilant in allocating time wisely. I need to be well versed in many areas beyond product, current affairs and finance, and learn more about the arts and cultures, and even stand-up comedy and modern music, to ensure I bring value to the people around me. Moreover, because my closer contacts are of an international background beyond local Singaporeans, I need to be very self-aware on the language used - to explain finance concepts in 90 seconds that even 10 years old can understand. As someone who manage my own money and studied and networked with other fund managers, a common theme we now share is that we need to sell our personalities, our ideas and the business we are in so that we can build a relationship that benefit both parties.

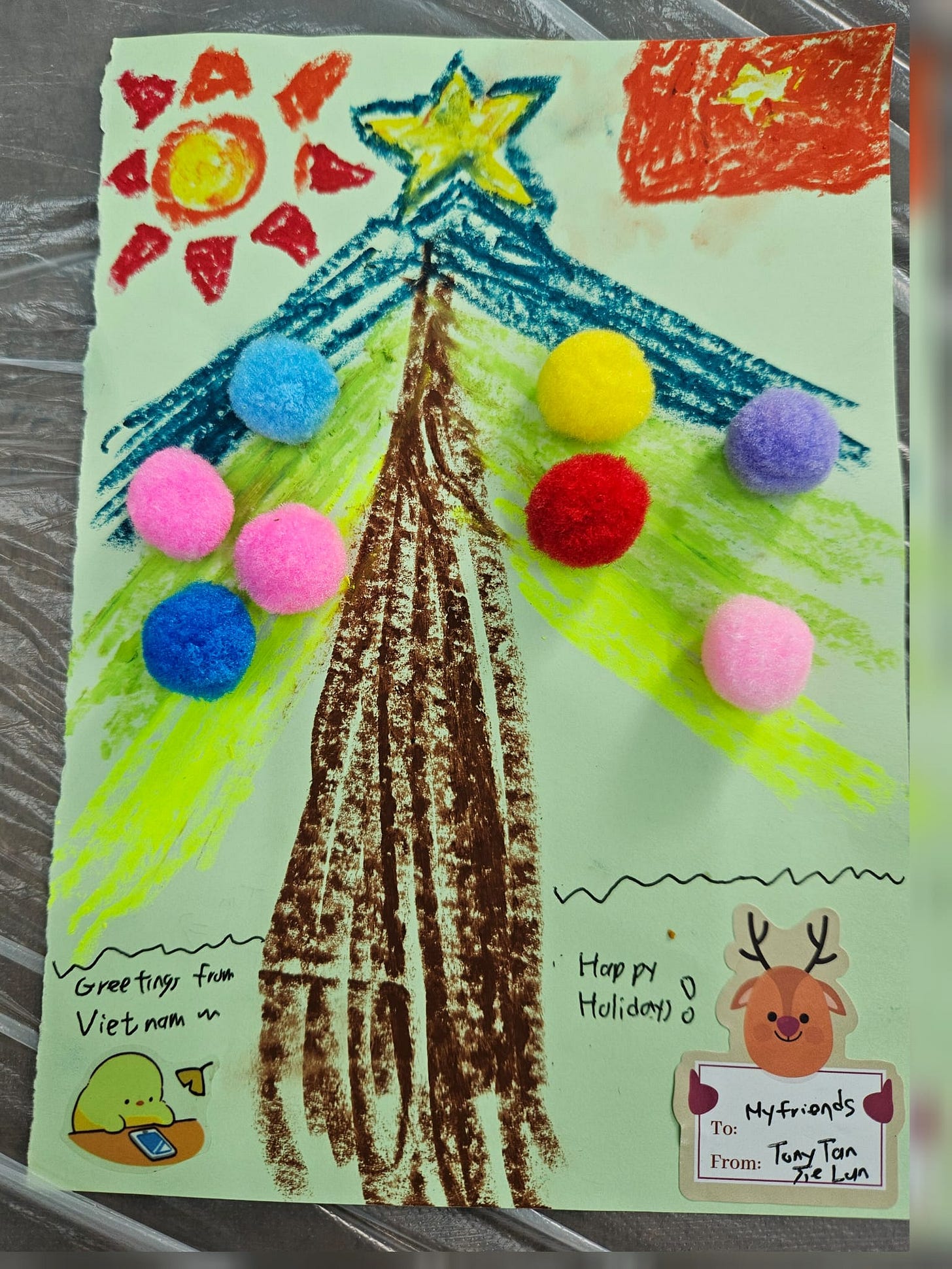

Service learning trip to Ben tre

The mission objectives are simple. Building a toilet. Repopulating the garden. And planting the seeds of knowledge to the next generation.

Having those grandiose ideas in your head is easy. Executing them takes a lot of sweat and hard work behind the scenes, from drafting up execution plans and procuring for logistics, practicing the games in person, and balancing the language barrier as well as the intellectual differences in primary school (Vietnam) vs Singapore. Nonetheless, what kept me going is the mission driven purpose that I will be building and contributing towards a meaningful and important cause, which beats going on an overseas holiday just to see monuments, taking photos as well as to eat and drink.

When I pitched this idea to my friends and clients, some of them thought I was insane and too old for these types of service-learning trips when I could be chilling at some beach halfway across the globe. The rebuttal I used is the same as what investors should do - The best time to start is 20 years ago. The next best time is to start today. In a way, I rather do it right now while I am still sufficiently energetic and fit and healthy without relationship commitments, rather than lose that privilege when I move on to a different life stage.

What I learnt about myself

As a service-learning trip, often than not we are placed in environments that we are uncomfortable with, from accommodations to language barriers to even the food we like or learn to like.

1) Improvisation on the spot is not my strongest suite. Speaking slower and exhibiting the right body language helps to position me in a position of authority and allow for more time and brain space to think. Exhibiting confidence and direction as a leader and lesson planner is more important than being obsessed with the microdetails, and I am fortunate I have a capable and energetic team to support me along the way.

2) I am way better at environments whereby the environment is quieter and I am engaging smaller teams. Loud noises and chaotic unfamiliar environments exhausts me easily.

3) Simplicity must be integrated with strong communication and execution. If you find the right audience with the right energy and attitude. A simple children game can be insanely fun and addictive. Keeping tabs on the audience mood and momentum is more important than having an engaging yet complex plan in your head that others cannot easily follow.

4) I am better at preparing and engaging professionals at an intellectual level compared to synchronizing with hyperactive children. At a personal level, I enjoy learning about the stories of people that are different from me. This range from bunking with a startup founder and other younger students, meeting connectors evangelizing for social causes and providing subsidized office space in Vietnam, and reconnecting with friends that I met in Vietnam last year.

From the conversations I have, I believe that Vietnam still had a lot of blue ocean opportunities to capture in terms of infrastructure, investments, tourism in unexplored areas. I hope to be a connector that can allowing Singaporean businessmen and startups to connect with locals to scale their businesses to Vietnam, and vice versa for Vietnamese who need Singapore as a place to expand their business networks, arrange for funding, as well as investment and estate planning opportunities.

There are challenges in Vietnam nonetheless. HCM alone contribute to 16% of Vietnam’s GDP and interest rates are at 10 percent, making it an important business center but also making it difficult for small business and organizations to secure funding. Real estate prices are at an all-time high and no cheaper than Singapore, making it difficult for low-income locals to have a decent standard of living at the prevailing median wage. The current investment appetite is not the best when I networked with the professionals and business volume is slower, necessitating startups to setup office in Singapore to procure funding while routing the lower cost operations and staff costs to Vietnam.

5 ) Comparing ShenZhen, Singapore, HoChiMinh, and New York (The major cities I have been to in the past), New York and Ho Chi Minh has the starkest differences between the rich and the poor by far. In the soup kitchen I volunteered in HCM, we were preparing subsidized meals at 2000 dong (0.11 SGD) and I can still see drifters raiding the food waste box for food. Whereas in Singapore, food waste is the norm and not the exception. The public infrastructure (bus and metro network) and social safety net in Singapore is way stronger compared to aforementioned countries.

Portfolio decisions

After leaving my previous role, I have the liberty to experiment with different retail brokers to better understand their latest offerings and product strategies, and their level of support to more sophisticated investment strategies. This is also to investigate which platform has better execution / better serves my clients interests.

Also related to my passion for the markets, I have more time to research on the better performing funds and the different investment philosophy and strategy of those fund managers. This is in order to provide guidance for both hands-on and laissez-faire investors. An interesting note is that even between different tech funds, there are different allocations to software and hardware to reflect the different philosophy on growth areas in the technology field.

I was fortunate that my investment portfolio hit another new milestone while I was on my service-learning trip in Vietnam. My current portfolio allocation reflects my personal bullish view on hardware tech over software in the US market. I am implementing a barbell philosophy whereby the current portfolio is still heavy in US tech (unchanged), but to balance out the higher valuation risk, I am accumulating positions with lower valuation risk (energy and oil) which is still set to benefit from the US-CN technology war, as well as cash warchest so I can capitalise on any unexpected shock or market correction. This is not financial advice, but rather to be accountable to myself on my rationale for allocating / divesting so I will handle my and my clients accounts with the same thoughtfulness and fiduciary standard.

Buy positions

Increased position in brookfield corp

07/11/24 at 75.5648

30/08/24 at 64.9458 and 65.2380

Initiated position in Brookfield asset management on

29/08/24 at 54.0150

Initiated position in OVV

07/11/24 at 55.4608

Built up position in Nvidea on

23/08/24 at 128.40

29/08/24 at 121.14

29/08/24 at 121.4897

29/08/24 at 120

Initiated position on Nike on

19/08/24 at 108.8573 and 108.8572

Initiated position on Asml on

21/10/24 at 945.4605

Increased my position on Goog on

14/08/24 at 164.500

Initiated position on Airbnb on 07/08/24 at

144.7229

Sell positions

Bought Fullerton Cash fund on 22Aug to capitalise on the bonus interest rate. And in lieu of the stock correction at December liquidated my Fullerton cash fund on 23 Dec to unlock cash for the potential opportunities that pop up.

Sold my residual stock awards in Tesla on

590.6306 on 16/12/24

Sold my residual stock awards in Grab on

4.1667 on 29/08/24

Conclusion

2024 is a period of huge change in my professional career as well as my personal life. Managing the transition is not easy and I need to strive to better myself every single day, no matter how little progress it can be.

In a way, the Vietnam service-learning trip helped me to break away from the trappings of Singapore, gained a different perspective on opportunities beyond borders, and is a breath of fresh air as I put myself in a different environment to help me figure out how best to execute the next steps. I am also grateful for the friendships and professional relationships I gained along the way and I hope to make something out of it in the future.

To end off the previous year on a good note

The old year fades, a whispered sigh,

New hopes arise, as moments fly.

A fresh start dawns, a brand new page,

To turn a brighter, happier age!