Reexamining the Kelly Criteria - When a sexy model goes rogue

One of the more interesting articles I came across recently is that of Sam Bankman Fried lawsuit, whereby the genius trader reportedly uses the Kelly Criteria in his career betting on ETF Trading / arbitrage, crypto cross-border arbitrage as well as personal decision making, before scaling his strategy / bets and running one of the largest crypto exchange FTX.

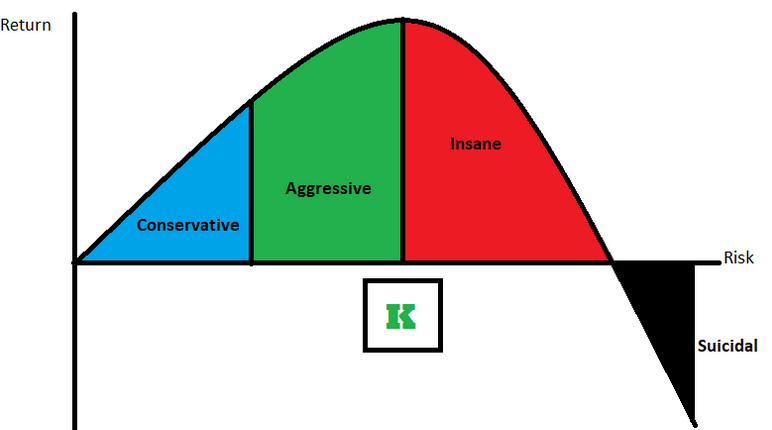

Having studied the Kelly Criteria back in my university days and influenced by a certain financial blogger in my younger days (whom propagated a leveraged dividend REIT investing strategy) (Aka an interest rate carry trade), I was seduced by this concept whereby you can optimise your position betting and bet heavily when the odds are good. Reportedly, Value investing / Growth At Reasonable Price reportedly uses the concept of a (Margin of safety) to bet heavily when the odds are in your favour, and the Kelly Criteria is a mathematical concept designed to model this.

The Kelly Criterion is a mathematical formula used in gambling and investing to determine the optimal size of a series of bets or resource allocation.

Pizza Slices: Imagine you're at a pizza party, and you want to determine how many slices of pizza to take. You could humorously apply the Kelly Criterion to maximize your pizza enjoyment while minimizing the risk of overeating.

Netflix Binge-Watching: Calculate the Kelly bet size for the number of episodes to watch in a binge-watching session. The goal would be to maximize entertainment while minimizing the risk of falling behind in daily responsibilities.

Dating: Swiping Strategy: In the world of online dating, you could create a humorous scenario about applying the Kelly Criterion to decide how many profiles to swipe right on. The goal would be to maximize your chances of finding the perfect match while minimizing the risk of getting overwhelmed.

Buying Ice Cream: Determine the optimal number of scoops to order when you visit an ice cream parlor. Maximize your deliciousness-to-stomachache ratio!

Choosing Friends: Use the Kelly Criterion as a method for deciding how many new friends to make. Maximize your social circle's quality while minimizing the risk of being overwhelmed with commitments.

If this concept is that powerful, why did Buffett and Munger askew the use of mathematical models in their investing strategy, in favour of investing principles and heuristics? Acolytes of the pair like Mohnish Pabrai, whom favoured the concept in his book <The Dhandho Investor> reportedly removed the use of this rule as a value investing concept. Some of the answers could probably be found in the decisions that are embedded in the latest book by Michael Lewis <Going Infinite>.

At SBF formative years whereby he was a trader at Jane Street, the internship training / institutionised behaviour of Jane Street is to encourage interns to bet with each other, while managing the downside risk and not allowed to lose more than $100 per day. Because of the culture of aggresive risk taking, interns felt compelled to gamble their entire $100 daily stake on a coin flip with 1% edge. Essentially, A Jane Street intern had an implied professional obligation to take any bet with a positive expected value, take outsized bets in their individual positions, and manage their downside exposure.

From a bottom up perspective, Jane Street hires the smartest and the most astute traders to take oversized bets in their individual positions, with capped downside via risk management. At the macro level, Jane Street is not betting its entire bankroll on any one intern, or trader, or trading team. Jane Street has a diversified portfolio of (theoretical) independent positive-expected-value bets created by different traders. If one trader bets her whole bankroll on a trade and it blows up, that’s fine for Jane Street: They have lots more traders doing bets like that, and in the long run the good bets will make more than the bad ones lose.

One specific example back at 2016 whereby there is an individual trader that made a wrong sided bet in the 2016 election and ended up up losing $300 million. Most unusually, there was no big firm-wide formal postmortem. No one was punished, or even questioned. SBF admired the way the firm distinguished process from outcome. A bad outcome on its own did not suggest anyone had done anything wrong, any more than a good outcome suggested anyone had done anything right

In summary, there are 5 unique practices that institutional traders practice, that differ from what most retail traders practice.

i) Kelly Criteria at micro position sizing. And capital allocation (diversified bets with uncorrelated star traders) at the macro level.

ii) At the micro level, If every Jane Street trader took the optimal amount of risk and leverage for her, he would probably put a high premium on not losing everything and risking his career. He will bet too small for the firm. Jane Street has to train the risk-aversion out of him.

iii) At the macro level, It is optimal for a firm like Jane Street with a lot of traders to encourage each of them to take a lot of positive-expected value risk, because Jane Street has enough of them to benefit from the law of large numbers. With enough independent positive-expected-value bets, it will make money, even if some traders lose money.

iv) Due to the probabilistic nature of financial markets, it is important to distinguish process from outcome. Good process can fail to work on individualized bets and the trader / investor MUST be intellectually honest on whether he was skilled or he got lucky.

v) A trading strategy that compensated the individual traders so well at the micro level, could have misaligned the risk appetite of the individual traders. SBF aggressiveness might have worked really well and was well compensated within the restrictive environment of Jane Street, but it blew him up once he was on his own.

An an individual investor whom is learning from this debacle, I believe there are loads of nuggets of wisdom (and horrific mistakes that he made), that can be gleaned from this star trader, which is around my age but mathematically more gifted than me. I look forward to following the developments from this case and learn from the triumphs and tragedies around the FTX Debacle

Portfolio Decisions for the month of October

I sold off my residual position in Silverlake Axis at SGD 0.27 after recognising that the cyclical upswing in contract demand for Core Banking Service in Silverlake Axis is less than expected and did not turned out as planned, and I do not see any possibility of large revenue increase in the core banking business. I do not believe that the retail POS system is likely to be a market leader in the SouthEast Asia Region given the presence of the Chinese / US technology giants whom is growing their B2C presence in Asia, and directly disrupting the clients of this technology. I also do not have any circle of competence in the insuretech industry, considering the fact that the fintech space is highly contested in SG, with multiple players hiring for top tier talent. Despite buying a seemingly superior business at a low valuation, this might be a bet that simply didn’t work out and I will decide to recycle capital to be allocated to other areas with higher potential upside.

I divested my cash portfolio stake in the Singapore Exchange. I still believe in the long term thesis of SGX as a multi-asset exchange, with the growth story in the derivatives market. The CPF allocation is retained as I find the dividend yield and rate of return is superior to the CPF interest rate, but for the cash component, it could be better used to be deployed in other areas especially in the current market correction.

I presented the book (Building Wealth Through REITs) in the book club I frequent (with my own thoughts) and hoped to clear up some doubts about REIT investing. (And to alert them about certain issues that transpired ever since the book was published). Rereading the book is a trip down memory lane, and also led me to defer from making any bets in the China property market (CICT REIT). I will probably blog about the lessons from then till now in my next post.

Conclusion

Reservist is an unusual time whereby I can take a break from the frantic tempo at work, deeply focus on myself, catch up on the readings that I enjoy, and connect with people I known for close to a decade. I also feel better after the regular routine of constant rest, gym and sunlight. Until then, I will pace myself while putting in effort to flesh out my next post!