The Berkshire Bonanza: Wisdom and Wealth at the AGM!

After taking a hiatus from writing, I decided to resume my interest to write about areas I am passionate about, namely equity investing, market quirks, and personal growth. I migrated from blogger to substack to better connect with talented writers, and is trying this new platform out!

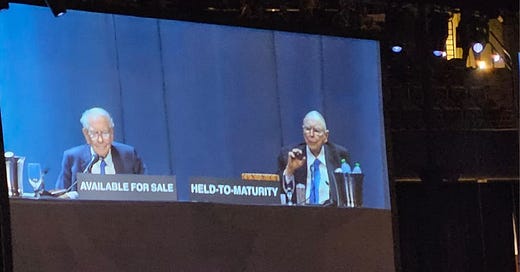

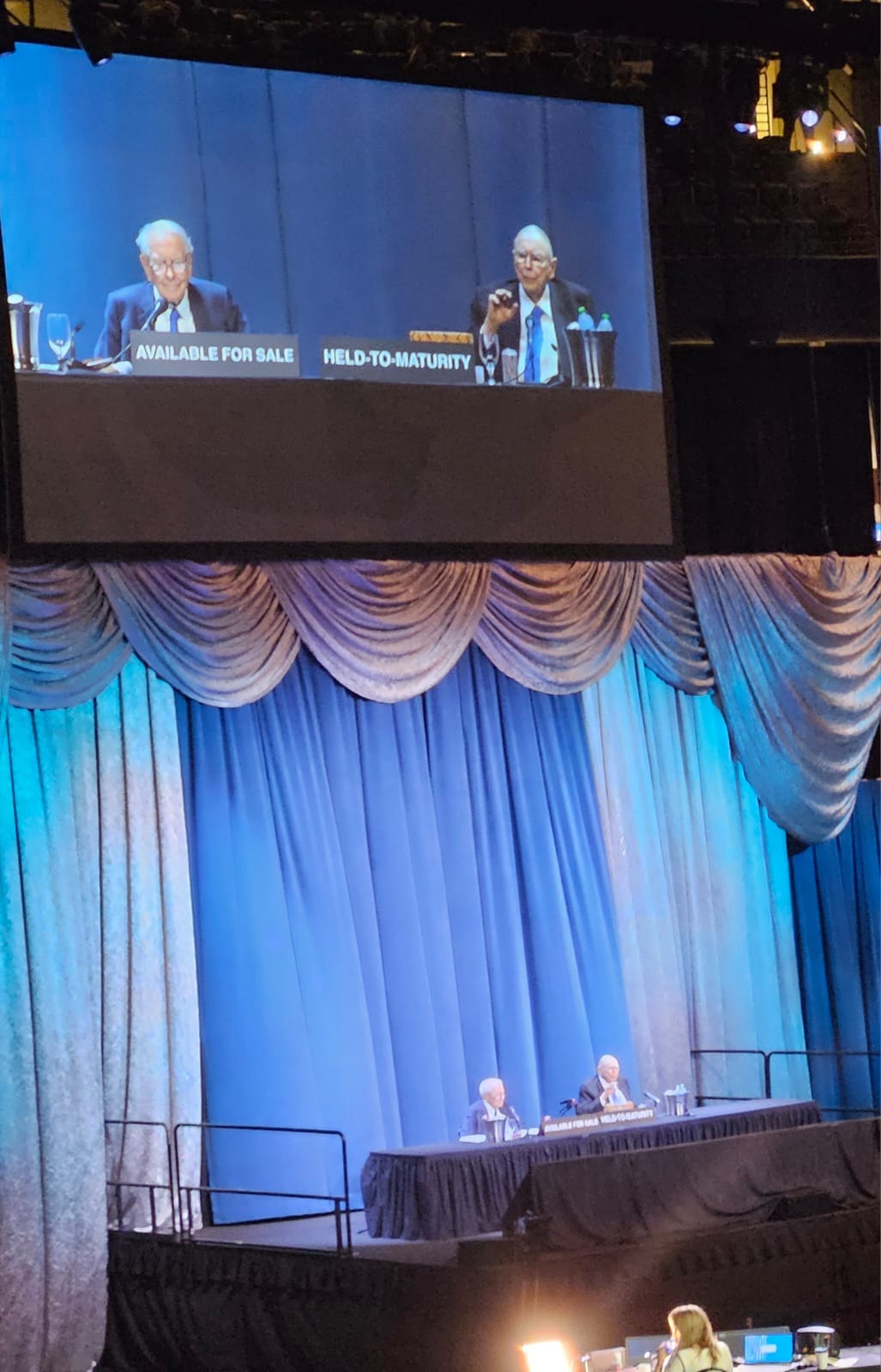

Having followed Buffett since I was 23 years old, these pair’s lessons and insights has greatly influenced me to adopt a more positive outlook on life. Now at the age of 32, I decided to clear my bucket list and meet the Berkshire pair before they join the queen. I was incredibly fortunate to be able to connect with a Singapore investing group that was going to the Berkshire 2023 AGM, and further managed to pool resources with a couple to tour different parts of US together, namely New York, Omaha, and San Francisco! Traveling to different states with the dynamic duo, exploring different lifestyles and pace of living, co-living and interacting with the locals there allowed me to reconnect with my inner self, and reset my perspectives from the daily grind. As transcripts / lessons of the AGM is probably widely available by the time I pen this post, I will try a contrarian take and deliver my insights from a first person perspective.

Reflections from the 2023 AGM

Pearls of Wisdom

1) Great storytelling is an incredible tool of influence and form of self growth

One special trait that distinguish Berkshire’s AGM from the other Singapore AGMs and US AGM (Markel) I attended, is that Buffett and Munger uses storytelling to recount complex and difficult times, how they survived through it and share those learning with younger folks. Through processing and sharing these first hand accounts with others, it allows them to better understand themselves, compound their knowledge, as well as help people bond together.

One amazing trait that most people missed out is the protégé effect which is practiced in peer learning / teaching groups. Actively mapping out and connecting key concepts, and simplifying and explaining concepts to the point that even a 10 years old can understand, truly tests your understanding of the matter and keep your mind sharp. It is amazing to see Buffett (93) and Munger (99) to be sharper than most peers that I interact with on a daily basis.

2) Celebrate the small things in life and learn to be happy.

You don't want to be a no emotional person in your life. You don't have force yourself to do anything you don't feel like doing. Focus on effort and consistency in the areas you are truly passionate about.

Life is too short to be shadowed by unhappy people / things in your life. One insight I had from Munger is that his life has been plagued by a series of unfortunate events, from the death of a son, divorce and remarriage, near complete blindness in his fifties, and wheelchair bound at his current state. However, he has his identity as a complete investor, reader, grandfather, and still managed to stay cheerful and sharp at the age of 99.

Staying stoic in the clutch of dire circumstances is how most people cope. Munger however had progressed beyond that and learnt to be cheerful and witty. His joyful attitude towards life probably contributed to his health and longevity. Some people that I knew personally had a rough start in life but managed to adopt a positive persona and attitude, and pursue a life that is worth living. I am also learning to count my blessings and be thankful for the things and people that came into my life, and live in the moment and be happier.

Passion is great, but it comes and goes, so it doesn't need to be the driving force behind my investing and my writing . Consistency is what's going to make me successful, and get me through those tough times. Reflecting on financial news and upheavals improve my clarity of thought as an investor, and also improve my depth of knowledge in the areas I manage.

3)The world is driven by money. The trick is figuring out how not to be controlled by it.

Reflecting on the extreme lifestyle difference of the poor VS the affluent in New York, it is no fun being a homeless street bum in a capitalist country. Without money and have the basic comforts of your life resolved, every step will be a tough grind. In a way, Buffett / Munger and the Omaha farmers whom own the A shares are incredibly lucky they have the insight, the happenstance of the American tailwind and the sequence of events, that allowed them to compound their wealth to such extreme levels.

However, being too obsessed with money without a defined target sum will ensure that I will be in a constant state of divine discontent. It is good to set a target sum to live comfortably by and not let lifestyle inflation erode the rest. Lastly, even if you have all the money in the world, if you and your partner have a miserable / toxic attitude, or are unable to feel content despite attaining your target financial goals, all the money will not save you.

4) Learn to develop a model in my mind to map my life and the world.

In this bewildering world whereby change is the only constant, I will need to refocus and have a grasp of the mega-trends, reforge a mental model of this brave new world, to better understand and navigate through it. My AirBnB host graciously shared her views and her vulnerabilities whereby she was terminated from her career role due to health conditions, leading her to be shaken from her life purpose. This is extremely traumatizing especially when she has put in so much effort and energy in her career and corporate identity.

Similarly, I had strong cognitive dissonance for the past few months due to unhappiness in my personal life, toxic people in my living environment, and issues with advancement / progression at work. I now understand I cannot let my work and those toxic areas be the sole purpose in life.

I have a choice to do my current job and learn ways to be thankful and find a purpose / goal outside of work, or search for horizontal opportunities as required. I also made the choice 6 years ago to invest in the event that circumstances forced my hand. I should not let temporary setbacks in life to allow me to lose faith my life purpose and goals.

Paths to Wealth

5) Why did Berkshire succeed

In an unusual way, Berkshire is supported by the American tailwind, a loopalooza effect of natural seabound protection from invaders, the positive optimism about embracing new technology and practices (nuclear power), and development of scientific tools and business techniques that succeeded massively.

The Berkshire pair also admitted they are backed by a lot of luck and perfect circumstances whereby they learnt a lot of timely lessons, learnt to optimise their lifestyles with caffeine and sugar, lucked out with special talents like Ajit Jain, and have major events (winning of WW2, See’s Candy acquisition, Saloman brother crisis ) going their way. Aside from luck, they deliberately designed a culture to balance current profits and future moats, wherbey Berkshire has no pressure from outsiders to raise money, explain share prices, and create a cultural fit and alignment of loyal shareholders and commuted managements

What can kill Berkshire

Internal riot and strife (tribalism destroying the American Tailwind).

Democracy and popular vote promoting short term goals

Activist investors pulling out cash reserve and float.

Writing of short term low Float insurance policies. Reinsurance policies with eroding margins or erroneous underwriting. Property catastrophe blowup (nuclear, cyber, unprecedented)

Inability to hold enough float to capitalise on investment opportunities

Loss of culture of trust that can affect management of the conglomerate

6) Investment Insights

Japanese exposure

Scuttlebutt - Through business relationships and scuttlebutt, the Japanese commodity house are understandable business, with decent dividends and conducting share buyback, and Berkshire can take out currency risk via financing for cheap,

Energy exposure

Population growth and energy consumption is set to increase over time, as the economy digitalize and US citizens consume more in the fores-sable future. Technical benefits in energy tax credits

Exit of TSMC exposure

Different countries will have diff policies and concerns (tribal policies) . There is no need to invest large amounts until you can fully accept the risk / or find a way to manage the exposure / PR issues

7)Reflections

I am trying to reflect on the direction I am trying to take my investment journey next. I am grateful to the people I have met in my pilgrimage to Omaha. Talking to wiser and more experienced investors forced me to critically reevaluate what I wanted to obtain out of my life. Until then, I will continue to explore and understand myself, and restructure my life / portfolio for the challenges ahead.